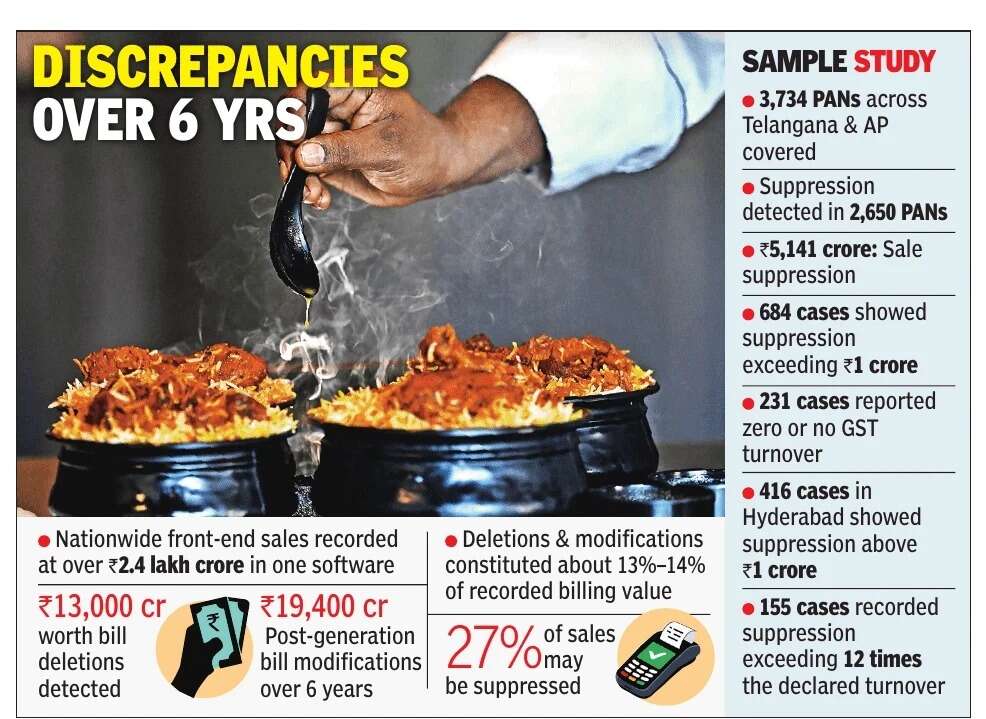

HYDERABAD: An in-depth investigation into biryani restaurant chains in Hyderabad has blown the lid of a larger tax evasion scam in the food and beverages industry that runs into thousands of crores.By analysing 60 terabytes of transactional data of a pan-India billing software used by more than one lakh restaurants, the Income Tax department’s Hyderabad investigation unit has revealed that these eateries suppressed sales turnover worth at least Rs 70,000 crore since the 2019-20 financial year.Officials are yet to calculate the tax with penalty on the suppressed income. They added the software they tracked controls about 10% of the total restaurant billing software market.Investigators used big data analysis and AI tools, including Generative AI, to crunch the data spanning 1.77 lakh restaurant IDs. Across India, the software provider recorded post-billing deletions totalling Rs 13,317 crore out of the Rs 70,000 crore. In Andhra Pradesh and Telangana alone, the suppression of sales reached Rs 5,141 crore.Also read: The great billing heist: How powerful ‘delete’ software feature helped restaurants hide crores from tax net; invoice of Rs 2,784 ‘altered’ to Rs 27Detailed physical and digital inquiries in a sample of 40 restaurants in Andhra Pradesh and Telangana detected suppression of about Rs 400 crore.

The top five states where evasion was detected were Tamil Nadu, Karnataka, Telangana, Maharashtra and Gujarat.Karnataka logged the highest instances of deletion at roughly Rs 2,000 crore, followed by Telangana (Rs 1,500 crore) and Tamil Nadu (Rs 1,200 crore). Officials said, some restaurants did not even bother to delete their records even as they under-reported sales in their income tax returns. Based on a sample estimate, officials have concluded that 27% of total sales were suppressed.Working from data accessed at the billing software provider company’s centre in Ahmedabad, officials analysed transactions at the department’s digital forensic and analytics lab in Ayakar Bhavan, Hyderabad.Inside the playbook: deletion, edits, and under-reportingInvestigators said restaurants typically enter all sales – card, UPI, and cash – into the software to prevent internal manipulation by servers, cashiers, and managers.Documents accessed by TOI revealed that one pattern flagged was the selective deletion of cash invoices, where restaurants allegedly retained only a portion of cash entries and deleted the rest to reduce income tax and GST exposure.Another pattern was bulk deletion, wiping bills clean for a chosen date range, including up to 30 days of billing, followed by filing returns that reflected only a fraction of the actual sales.Across six financial years from 2019–20 to 2025–26, the dataset covered billing of about Rs 2.43 lakh crore.The probe used high-capacity systems, while AI tools, including Generative AI, were used to quickly map GST numbers to restaurants using open-source information and publicly available online material.Initially, searches were conducted in Hyderabad, Visakhapatnam, and other towns in Telangana and Andhra Pradesh, which revealed that the software was being used for suppressing sales. The Central Board of Direct Taxes then decided to expand the probe to the rest of India. Officials believe their current findings are only the tip of the iceberg, noting multiple billing platforms operate in the sector and could face similar backend scrutiny.