2024-10-18 07:05:05

The value of Harvard’s endowment grew to $53.2 billion after the Harvard Management Company boasted a 9.6 percent return on its investments in fiscal year 2024 — the first year the endowment has increased in value since 2021.

The HMC’s strong investment returns — which are significantly higher than last year’s 2.9 percent returns — allowed the value of the endowment to increase by $2.5 billion from fiscal year 2023, the University announced on Thursday in its annual financial report.

The growth comes even as Harvard has contended with a significant drop in endowment gifts amid the ongoing backlash to the University’s handling of campus antisemitism.

This increase in the endowment value comes after two consecutive years of endowment drops, falling to $50.9 billion in FY 2022 and $50.7 billion in FY 2023. This reversal represents a return to the upward trend in Harvard’s endowment value over the past two decades.

HMC CEO N.P. “Narv” Narvekar wrote in the financial report that Harvard’s endowed funds has a target return of 8 percent, and the annualized return of 9.3 percent averaged over the past seven years has “more than kept pace” with that target.

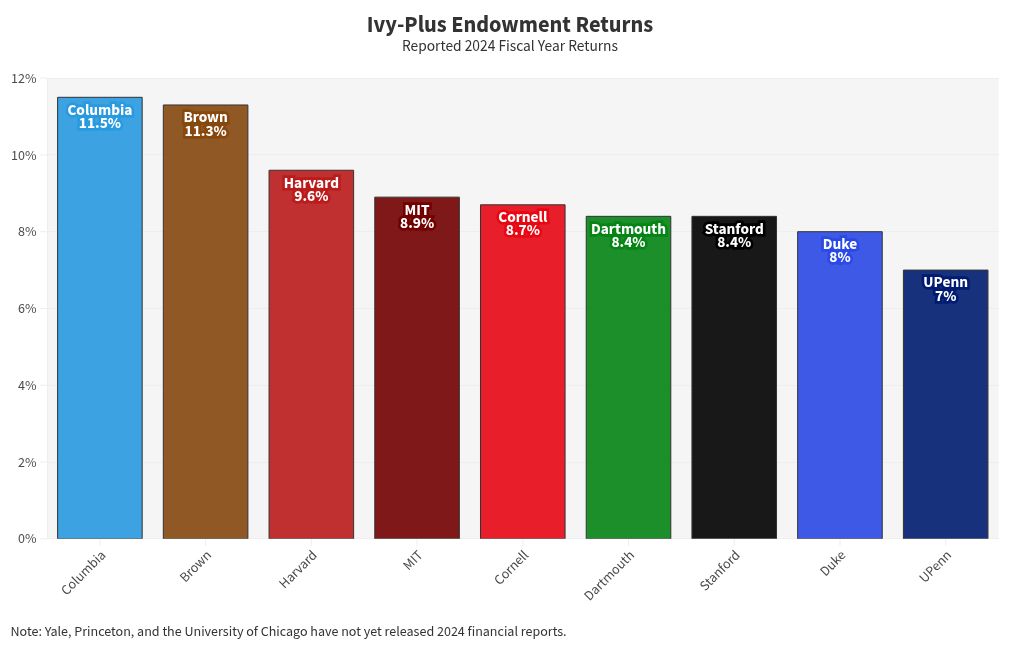

Though some critics have said Harvard’s endowment has underperformed in recent years, with an investment return of 9.6 percent this year, Harvard is third only to Brown and Columbia among its Ivy League+ peers, which delivered 11.3 percent and 11.5 percent returns, respectively.

Endowment distributions in fiscal year 2024 totaled $2.4 billion — 37 percent of the University’s annual revenue — with funds going toward costs such as financial aid, faculty, research initiatives, and more. The contributions have allowed the University to commit $749 million in financial aid across the University, with $250 million provided to undergraduates, according to the report.

The largest allocations within Harvard’s endowment are to private equity and hedge funds, with private equity accounting for 39 percent of the portfolio and hedge funds accounting for 32 percent.

Harvard only allocates 14 percent of its endowment towards public equities due to its lower risk tolerance. Fiscal year 2024 was a strong year for public equities — with the S&P 500 often setting new record highs — but the HMC still delivered strong returns given its lower exposure to public equities.

“In FY24, public equity and hedge fund portfolios stood out for their strong performance,” Narvekar wrote in the report. “This is a particularly positive indicator, since HMC’s hedge fund portfolio has less equity exposure than most hedge fund indices, yet still outperformed during a strong year for equities.”

Harvard also reduced the endowment’s exposure to real estate and natural resources from 25 percent in 2018, to just 6 percent in FY 2024. This reduction has helped drive a positive impact on the endowment returns, according to Narvekar.

The University saw a budget surplus of $45 million in 2024, a significant change compared to the surplus of $186 million that Harvard operated with in FY 2023. Revenue growth of 6 percent was outpaced by the expense growth of 9 percent.

Vice President and Chief Financial Officer Ritu Kalra attributed the rise in expenses to HMC investing in its people.

“Our commitment to attracting and retaining top talent through competitive salaries accounted for just over half of the increase in compensation,” Kalra wrote.

Harvard President Alan M. Garber ’76 acknowledged the challenges facing the University in a message published in the annual report.

“The work ahead demands much of each of us,” Garber wrote. “Fortunately, we are people supported by generous physical and financial resources whose ambitions are limited only by our imaginations.”

“Our University will emerge stronger from this time — not in spite of being tested, but because of it,” he added.

Notably, endowment gifts to the University dropped from $561 million in FY 2023 to $368 million this year.

In the report, Narvekar noted the University’s increasing dependence on endowment distributions to fund its operations.

Twenty years ago, endowment distributions accounted for 21 percent of the University’s budget. Now, it accounts for almost 40 percent.

“The ever-increasing reliance on this critical resource makes our work all the more important,” Narvekar wrote.

—Staff writer Sidney K. Lee can be reached at si********@********on.com. Follow her on Twitter @sidneyklee.

—Staff writer Thomas J. Mete can be reached at th*********@********on.com. Follow him on Twitter @thomasjmete.