GURGAON: The Indian Cybercrime Coordination Centre (I4C) has issued a set of SOPs meant to ensure that online users who fall for cyber scams get their money back if they have reported the cases in time.

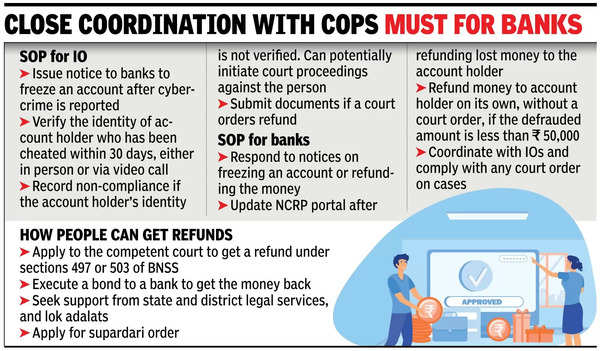

The SOPs include the role of an investigating officer, and that of banks in ensuring that a person who has lost money to a cybercrime gets it back.

I4C, established by the Union home ministry, provides a framework and ecosystem for law enforcement agencies (LEAs) to deal with cybercrimes in a coordinated manner.

Haryana Police additional director general (cybercrime) OP Singh told TOI on Sunday that the SOPs will streamline the process for the defrauded money to be returned to its rightful owner.

“The SOP clearly delineates the roles and responsibilities of investigating officers, banks and victims. The initiative is aimed to ensure swift and effective handling of cybercrime-related financial disputes, thereby enhancing public trust in the system,” Singh said.

Singh said investigating officers (IOs) play a crucial role. “The process involves several key steps. First, the IO issues a notice under Section 106(1) BNSS to the bank to freeze or disable digital transaction services associated with an account. Second, the IO ensures that the account holder appears for verification within 30 days, either in person or via video conference, to confirm their claim to the blocked funds. Third, if the account holder fails to comply or provide a satisfactory explanation, the IO records this non-compliance and may initiate court proceedings. Lastly, the IO follows court orders to refund the blocked money, forwarding necessary reports and bonds to the court,” he said.

Section 106(1) BNSS says that a police officer may seize any property that is suspected to have been stolen.

Under the new SOP, banks have specific obligations too.

They must refund the money to account holders on receiving a notice under Section 106(3) BNSS, which says that a police officer has to report seizure of property to a magistrate.

Banks are required to update the National Cybercrime Reporting Portal (NCRP) to maintain transparency and track case progress. For amounts less than Rs 50,000, banks can refund the money without a court order if deemed fraudulent, based on internal policies and Indian Banks’ Association guidelines.

People cheated by cyber cons have other options to reclaim their money.

They can file an application in a jurisdictional court under Section 503 of BNSS. This provision says that after a police officer reports seizure of property to a magistrate, and such property is not produced before a criminal court during trial or inquiry, the magistrate may order disposal of property, or delivery of property to the person entitled to its possession.

Another method is by executing a bond and submitting it to banks to get the amount remitted.

They can also utilise state and district legal services authorities and lok adalats for support. Additionally, victims can file an application for a supardari order, seeking the release of the money lost.