The passing of Giorgio Armani wasn’t just the loss of a legend; it was the starting pistol for the corporate dismantling of his entire empire. The man’s will is less a peaceful farewell and more a strategic merger and acquisition document, explicitly instructing his heirs to sell up to 54.9% of the company, with the first 15% to be offloaded within 18 months.

And he didn’t just leave it to chance—he name-dropped potential buyers like LVMH, L’Oreal, and EssilorLuxottica. It’s a stunning move that completely flips the script on his lifelong stance of fierce Italian independence, essentially placing one of the last great family-owned houses on the auction block for the conglomerates to fight over.

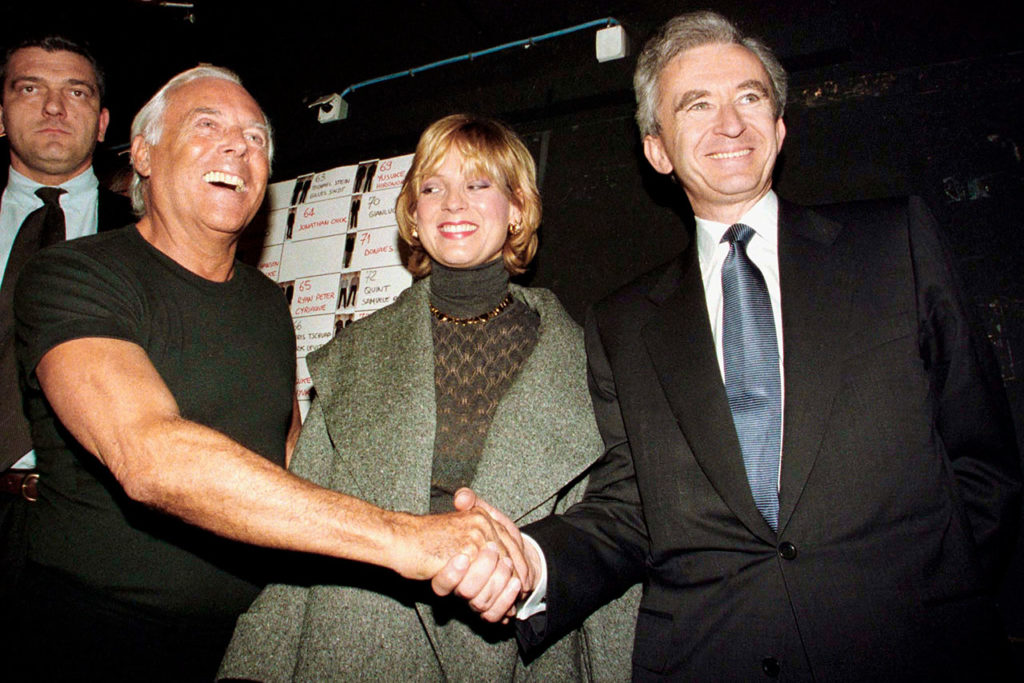

This sets the stage for a corporate showdown that will reshape the luxury landscape. LVMH’s Bernard Arnault, the ultimate chess player in this game, gave a characteristically polished response about being “honored,” which is corporate speak for “my team is already running the numbers.” But this isn’t just about one company; it’s about the final consolidation of power.

SR/AA

A foundation will keep a minority stake to “protect the legacy,” but let’s be clear—when your brand becomes a subsidiary in a massive portfolio, the soul of the company inevitably changes. The autonomy that let Armani build an icon is being systematically signed away by his own hand from beyond the grave.

For us watching from the sidelines, this is a masterclass in legacy and reality. Armani built a kingdom on his own terms, but his final act acknowledges that in today’s global economy, even the mightiest kingdoms get absorbed into empires. It’s a bittersweet lesson: you can spend a lifetime building something singular, but ensuring its survival might mean handing the keys to an entity whose primary language is shareholder value. The king is gone, and the future of his court is now in the hands of the financiers.

May Armani Rest in Peace, and may his legacy live on.