Image used for representational purposes only.

| Photo Credit: Reuters

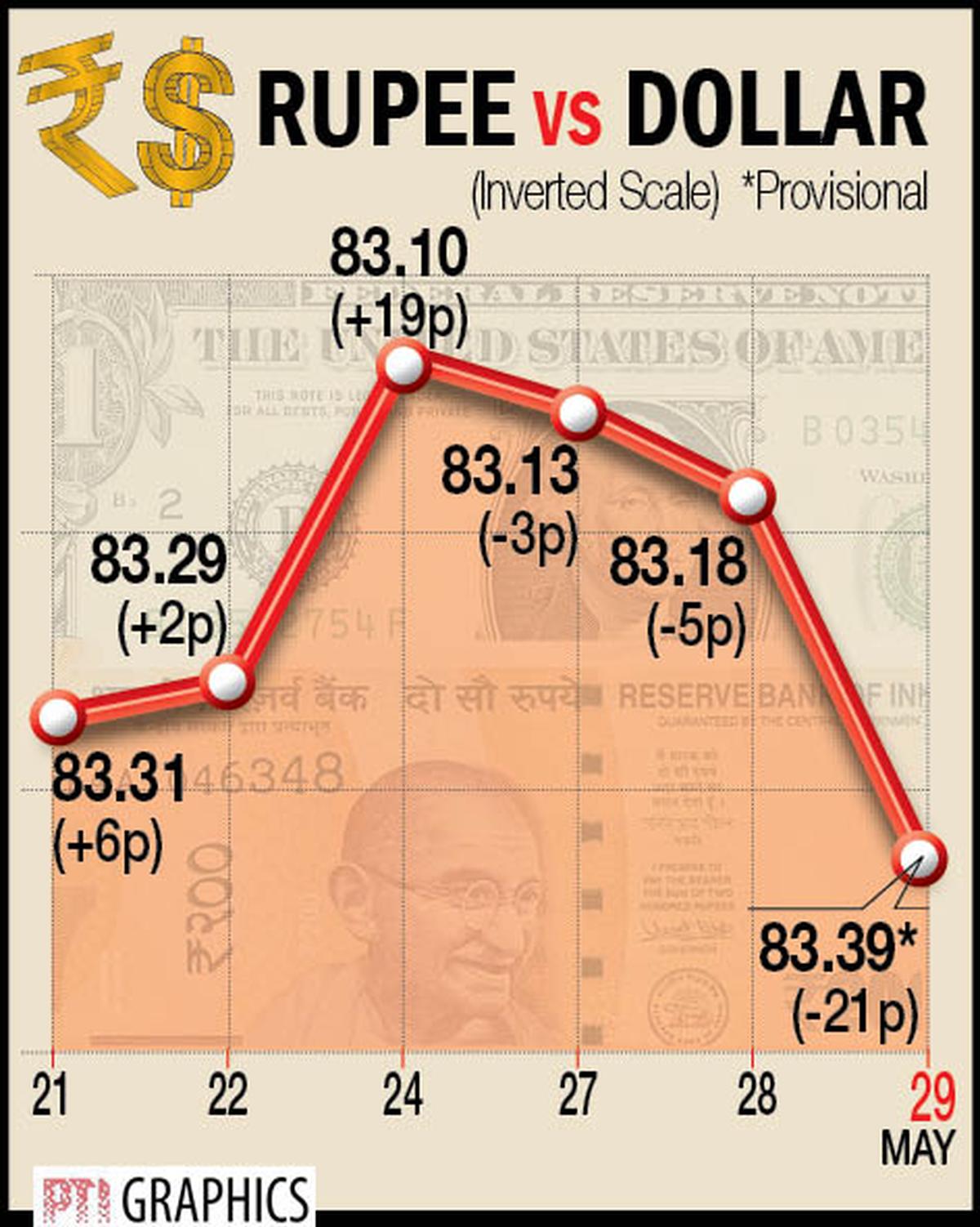

The rupee settled 21 paise lower at 83.39 (provisional) against the U.S. dollar on Wednesday, tracking a negative trend in domestic equities and elevated crude oil prices.

Forex traders said dollar demand from importers and oil marketing companies (OMCs) also weighed on the rupee.

However, foreign inflows in the bond markets ahead of inclusion on India’s government bonds in global bond index cushioned the downside.

At the interbank foreign exchange market, the local unit opened at 83.22 and finally settled for the day at 83.39 (provisional), down 21 paise from its previous close.

On Tuesday, the rupee pared initial gains to settle 5 paise lower at 83.18 against the U.S. dollar.

“We expect the rupee to trade with a slight negative bias on month-end dollar demand from OMCs and importers to meet their obligations. Risk aversion in global markets and a strong US dollar may further pressurize the rupee,” said Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas.

However, fresh foreign inflows in FPIs and bond markets may support the rupee at lower levels.

Traders may take cues from Richmond manufacturing index and speeches from U.S. Fed officials. Investors may remain cautious ahead of core PCE price index data later this week, Mr. Choudhary added.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading at 104.67, higher 0.05%, on hawkish Fed speak and upbeat economic data from the U.S.

Brent crude futures, the global oil benchmark, rose 0.78% to $84.88 per barrel.

On the domestic equity market, the 30-share BSE Sensex declined 667.55 points, or 0.89%, to close at 74,502.90 points. The broader NSE Nifty fell 183.45 points, or 0.8%, to close at 22,704.70 points.

Foreign Institutional Investors (FIIs) were net buyers in the capital markets on Tuesday, as they purchased shares worth ₹65.57 crore, according to exchange data.