The rupee appreciated by 3 paise to settle at 83.28 (provisional) against the U.S. dollar on Wednesday amid softening crude oil prices.

Forex traders said the local unit consolidated in a narrow range weighed down by foreign fund outflows.

At the interbank foreign exchange, the domestic unit opened at 83.29 and moved in the range of 83.22 and 83.29 against the greenback during the session.

The local unit finally settled at 83.28 (provisional) against the dollar, registering a rise of 3 paise from its previous close.

The Indian rupee gained on positive domestic markets and a decline in crude oil prices. However, mixed to positive U.S. Dollar and FII outflows capped sharp gains, said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

“We expect the rupee to trade with a slight negative bias as the U.S. Dollar may recover from lower levels if the Federal Open Market Committee (FOMC) meeting minutes are hawkish,” Mr. Choudhary said.

FII outflows may also weigh on the rupee. However, a positive tone in the domestic markets and weakness in crude oil prices may support the rupee at lower levels, Mr. Choudhary added.

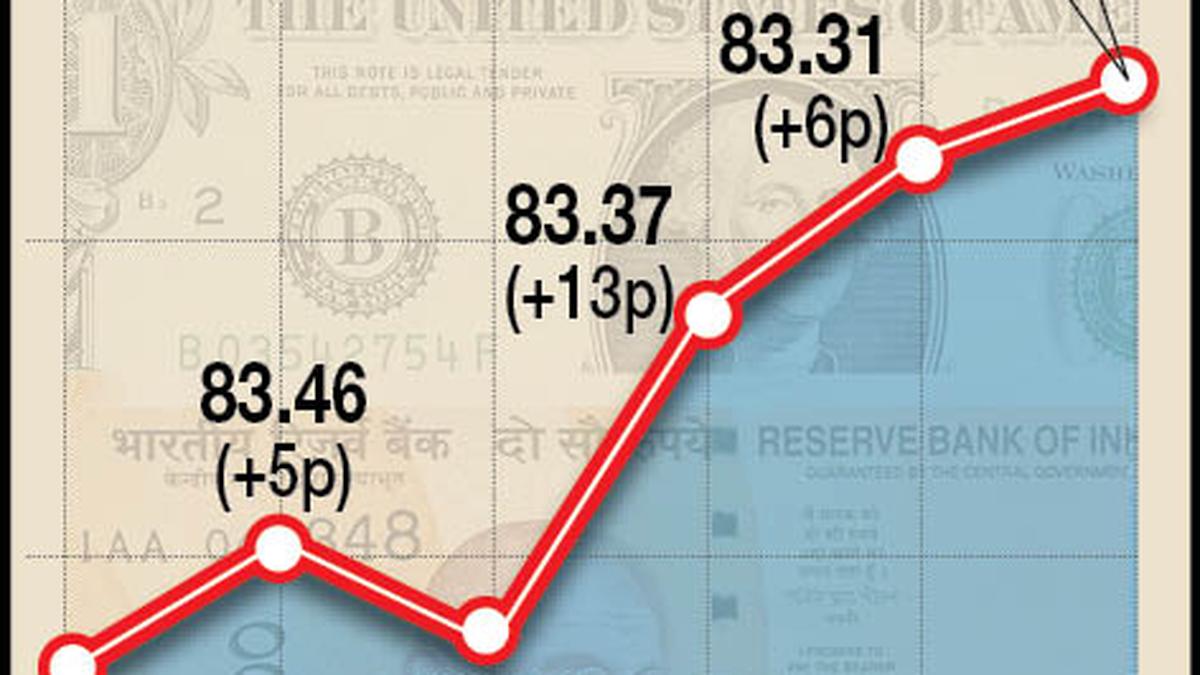

Investors may remain cautious ahead of PMI data from the U.S. this week. USDINR spot price is expected to trade in a range of ₹83 to ₹83.55, Mr. Choudhary added.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, advanced 0.09% to 104.75, as most Fed officials warned of cutting interest rates too early and need more data to cut rates.

Brent crude futures, the global oil benchmark, slipped 0.69% to $82.31 per barrel.

On the domestic equity market front, Sensex advanced 267.75 points, or 0.36%, to settle at 74,221.06 points, and Nifty rose 68.75 points, or 0.31%, to close at 22,597.80 points.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets on Tuesday, as they offloaded shares worth ₹1,874.54 crore, according to exchange data.

On the macroeconomic front, according to an article in the RBI’s May Bulletin released on Tuesday, India is likely to grow by 7.5% in the first quarter of the current financial year, driven by rising aggregate demand and non-food spending in the rural economy.