Madhabi Puri Buch, chairperson of the Securities and Exchange Board of India (SEBI). File

| Photo Credit: PTI

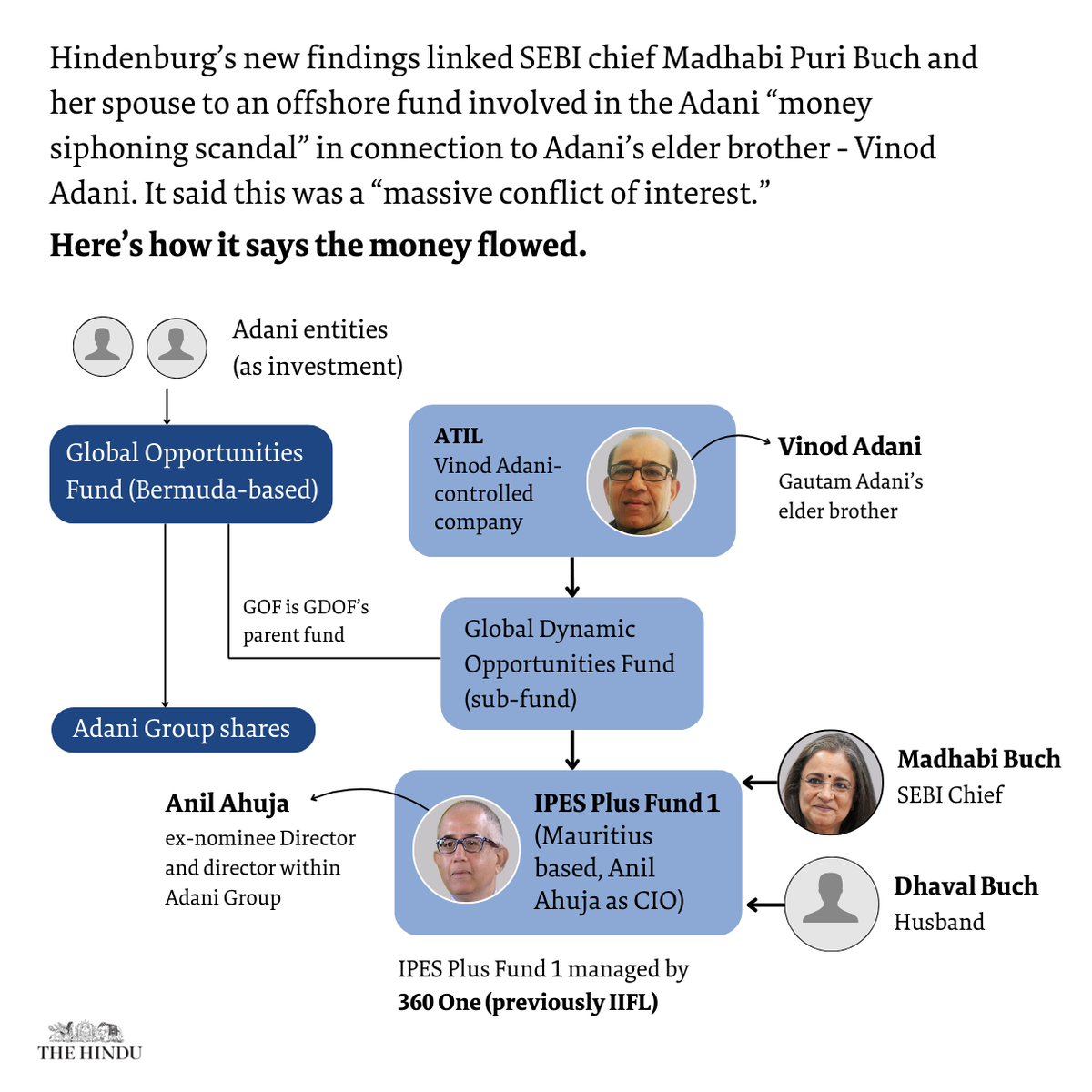

Hours after the stock market regulator’s chairperson Madhabi Puri Buch, and her spouse Dhaval Buch, issued a clarification on a Hindenburg Research report red-flagging their investments in obscure offshore funds linked to the Adani group, and ownership of consulting firms, the U.S.-based short seller said their rebuttal contains important ‘admissions’, raises fresh questions and confirms a ‘massive conflict of interest’.

Also Read : Hindenburg report echo: Adani group stocks tumble

“Buch’s response now publicly confirms her investment in an obscure Bermuda/Mauritius fund structure, alongside money allegedly siphoned by Vinod Adani. She also confirmed the fund was run by a childhood friend of her husband, who at the time was an Adani director. SEBI [Securities Exchange Board of India] was tasked with investigating investment funds relating to the Adani matter, which would include funds Ms. Buch was personally invested in and funds by the same sponsor which were specifically highlighted in our original report,” the firm said, stressing this was “obviously a massive conflict of interest”.

On the two consulting firms, Singapore-registered Agora Partners and India-based Agora Advisory, that Ms. Buch had set up before joining SEBI and were referred to in Hindenburg’s report, the SEBI chief and her spouse said these firms “became immediately dormant on her appointment with SEBI” and were used by her husband after he retired in 2019 for his own “consultancy practice”. The statement from Mr. Buch and Ms. Buch also said her shareholding in the Singapore entity had been transferred to him.

Hindenburg countered that Ms. Buch remained a 100% shareholder of Agora Partners Singapore until March 16, 2022, as per Singaporean records, owning it during her entire time as a Whole Time Member of SEBI. “She only transferred her shares into her husband’s name two weeks after her appointment as SEBI Chairperson,” the firm pointed out, adding that it is “impossible to see how much money this entity has earned during her time at SEBI” as it doesn’t publicly report its financials.

Also Read | Adani case: Supreme Court had said it can transfer probe if bias found

However, Ms. Buch continued to hold 99% of the shareholding in the India-based consulting firm as of March 31, 2024. Noting that the Indian entity is “currently active”, Hindenburg said it has “generated ₹23.985 million (~$312,000) in revenue during the financial years (‘22, ‘23, and ‘24), while she was serving as Chairperson, per its financial statements”.

On Ms. Buch’s remarks that her husband used the consulting entities since 2019 to transact with unnamed “prominent clients in the Indian industry”, Hindenburg asked if these included clients SEBI is tasked with regulating.

“This is especially important given whistleblower documents showing that Buch used her personal email to do business using her husband’s name while serving as a Whole Time Member of SEBI. In 2017, weeks ahead of her appointment as SEBI Whole Time Member, she ensured the accounts with ties to Adani “be registered solely in the name of Dhaval Buch”, her husband, per whistleblower documents,” it said in a response posted on X.

“Despite disclaiming control, a private email she sent a year into her SEBI term shows she redeemed stakes in the funds through her husband’s name, per the whistleblower documents. This raises the question: What other investments or business has the SEBI Chairperson engaged in through her husband’s name while serving in an official capacity?”, Hindenburg Research asked.

With the joint statement from the SEBI chief and her spouse promising a “commitment to complete transparency”, Hindenburg asked if she will “publicly release the full list of consulting clients and details of the engagements, both through the offshore Singaporean consulting firm, the Indian consulting firm and any other entity she or her husband may have an interest in”. “Finally, will the SEBI Chairperson commit to a full, transparent and public investigation into these issues?”, it concluded.